The 2 Best Cannabis Stocks to Own in 2021

June 23, 2025

Tax Preparation vs Tax Planning: Key Differences & Why You Need Both

January 15, 2026What is an IRS Notice of Deficiency?

Getting unexpected mail from the Internal Revenue Service (IRS) can make anyone nervous. One of the most serious letters the IRS sends is a Notice of Deficiency.

In fiscal year 2024, nearly 16,117 taxpayers took their petitions to the US Tax Court for similar notices, according to the National Taxpayer Advocate’s 2024 Annual Report to Congress.

If you receive an IRS Notice of Deficiency, this guide will help you understand what it means, why you’re receiving it, and what steps you should take based on your circumstances.

Because these issues can be complex, it’s wise to work with a professional tax resolution service like Karme. This way, you can respond on time and ensure your rights are fully protected.

What is a Notice of Deficiency from the IRS?

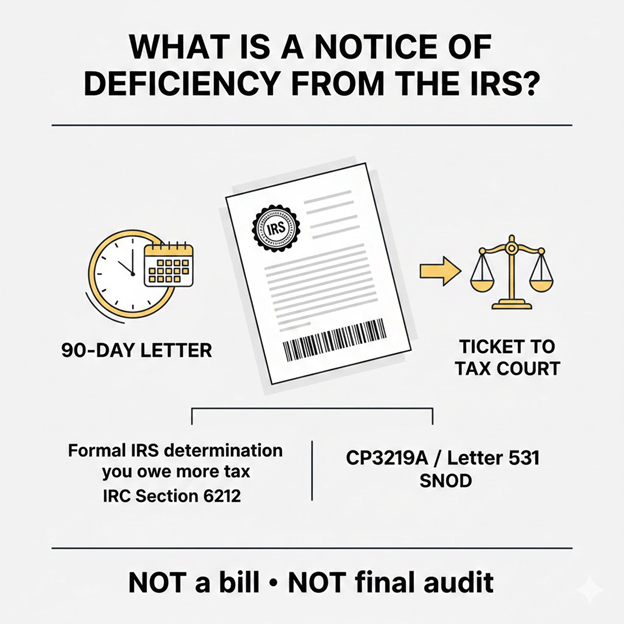

A Notice of Deficiency is a formal legal document, which means the Internal Revenue Service (IRS) has determined that you owe more tax than you reported on your return. It is authorized under Internal Revenue Code (IRC) Section 6212 and is officially labeled as Notice CP3219A or Letter 531.

Many people know this letter by a few other names. These include:

- The 90-day letter. This name shows the 90-day deadline to respond. The IRS can formally assess the tax after this period.

- The Statutory Notice of Deficiency (SNOD). This name signals the notice is not routine. Federal tax law requires the IRS to issue it.

- The ticket to Tax Court. This name highlights your legal right. You can file a petition with the United States Tax Court. This action lets you dispute the IRS determination before paying the tax.

Notice of Deficiency is not a bill. It is not the final result of the audit. The notice initiates specific legal rights and strict deadlines for your response.

Apart from the notice of deficiency, you may receive many other types of letters from the IRS. Learn more about what the different IRS letters mean.

Why Does the IRS Send a Deficiency Notice?

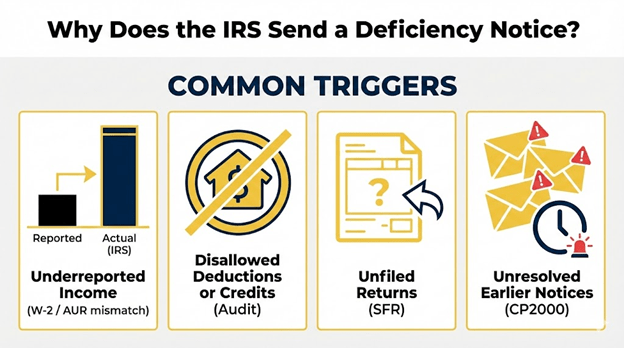

The main reason you’re receiving the tax deficiency notice is a mismatch between your owed and reported taxes. But many specific actions can trigger the IRS to send it to you. Let’s review the most common causes.

Underreported income

Underreported income happens when your tax return shows less income. Employers report income on Form W-2. Banks and clients also report payments you receive. If these amounts do not match your return, the IRS will use its Automated Underreporter (AUR) program to find these differences. If you do not fix the issue, you will receive a notice of tax deficiency.

Disallowed deductions or credits

During an audit, the IRS may reject some claimed expenses. This includes business costs, the Earned Income Tax Credit (EITC), or the Child Tax Credit. The IRS recalculates your income tax deficiency based on the amounts it disallowed. It then sends a notice showing your new income tax due.

Unfiled returns

If a taxpayer does not file a required return, the IRS prepares a Substitute for Return (SFR). It uses income information reported by employers, banks, and other payers. The IRS then issues a deficiency notice based on that return, which usually does not include deductions or credits.

Unresolved earlier notices

If a taxpayer does not respond to a CP2000 notice or a 30-day letter, the IRS treats the proposed changes as unresolved. The case then moves forward to a Statutory Notice of Deficiency.

It’s important to note that the IRS documents everything behind your deficiency adjustment through electronic codes.

What’s Inside the Deficiency Letter from the IRS?

The deficiency letter is a formal legal package. You need to understand what each component means so you can prepare to make a timely decision.

A standard notice of deficiency includes the following:

- A cover letter that explains why the IRS is sending the notice, the proposed amount of additional tax owed, and the actions you may take in response.

- Form 5564 (Notice of Deficiency – Waiver) for signing only if you agree with the IRS calculations. Signing removes your right to file a petition with the United States Tax Court.

- A detailed adjustment statement that shows how the IRS calculated the additional tax. It lists specific changes, such as unreported income or disallowed tax credits.

- Your response deadline is 90 days from the date printed on the notice if you live in the United States. If you live outside the country, you have 150 days to respond, under the Internal Revenue Code (IRC) Section 6213(a).

- Taxpayer Advocate Service (TAS) contact information for the IRS office that helps taxpayers facing financial hardship with their case.

What to Do After Receiving the Notice of Deficiency

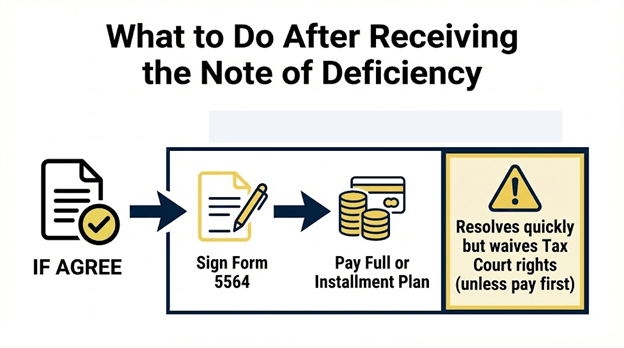

If you agree with the notice, you’ll need to sign and return Form 5564 (Notice of Deficiency – Waiver) to the IRS. After that, you can either pay the full amount owed or request a payment plan, such as an installment agreement.

The main benefit of agreeing is that it resolves the case quickly and avoids going to Tax Court. However, you will give up your right to challenge the IRS’s determination in the United States Tax Court without first paying the full amount owed.

What Happens If You Ignore the IRS Notice of Deficiency?

Ignoring an IRS notice of deficiency can make your tax problems significantly worse. Here is what the timeline looks like if you take no action:

- The deficiency becomes legally assessed. The IRS issues a formal bill that includes the assessed deficiency, all accrued interest, and applicable penalties.

- Enforced collection follows. The IRS can collect unpaid taxes aggressively. They can file a federal tax lien on your property. They can also garnish your wages. They may even levy your bank accounts. A federal tax lien, in particular, becomes part of the public record and can affect your credit. It can make it harder to sell property and also disrupt your business operations.

- Your Tax Court rights are gone. Without payment in full, you lose your Tax Court rights. You can no longer challenge the IRS figures in court. The 90-day prepayment protection expires permanently.

Should You Handle an IRS Notice of Deficiency Alone or With a Tax Pro?

Whether you need a professional depends on what you plan to do. If you agree with the notice and want to sign Form 5564, a CPA or Enrolled Agent can help you complete the process correctly. However, if you disagree with the amounts the IRS has calculated, the situation becomes more serious.

CPAs and Enrolled Agents cannot represent you in Tax Court unless they have passed the IRS Tax Court’s non-attorney admission exam. According to George Starkman’s website, only 202 non-attorneys have ever been admitted to practice in Tax Court since 1943. For any disputed notice, particularly one with a 90-day deadline approaching, hiring a qualified tax professional is the most appropriate choice.

Final Words

Receiving an IRS notice of deficiency does not mean the matter is final. You have options. You can agree with it, dispute it, or ignore it. But each choice affects your legal rights and your financial obligations. So, if you have received this notice, do not handle it alone.

At Karme, we provide professional tax resolution services to help taxpayers respond carefully and on time. Ignoring a notice of deficiency is always the most expensive choice. Contact us before the 90-day deadline to protect your rights and minimize potential penalties.